While first created to manage product lines for manufacturing companies in the ‘60s and ‘70s, it’s equally relevant for tech startups that offer a variety of digital services. Companies use the framework to decide which businesses or products to invest in to maximize growth potential and profitability. The different categories help you simplify complex decision-making about investment and business focus. Question marks: Currently low market share in a fast-growing market.Dogs (or pets): Low market share in a market with a slow growth rate.Cash cow: High market share in a mature market.

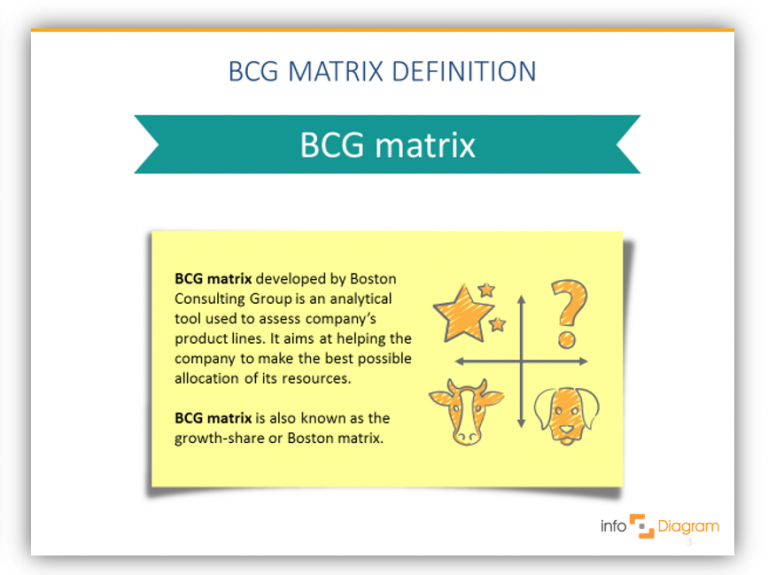

Relative market share: Your share of the market compared to your largest competitor.To help you roughly estimate the profitability of a business, the matrix uses the two metrics of relative market share and market growth rate. It divides a company’s business units into categories based on their respective market shares and market sizes. The Growth Share Matrix, also known as the BCG Matrix, is a portfolio management framework developed by the Boston Consulting Group’s founder in 1968. BCG Matrix definition: What is a Growth Share Matrix?

0 kommentar(er)

0 kommentar(er)